[RFC] - SPELL Market Making Proposal - Arrakis PALM

Summary

Deploy Arrakis PALM to conduct market-making on UniV3 for SPELL.

Introduction to Arrakis Finance and Arrakis PALM

Arrakis Finance is Web3’s trustless market-making infrastructure protocol that enables running sophisticated algorithmic strategies on Uniswap V3.

Since launch, Arrakis has achieved

-

$1.7b in TVL at its peak (currently around $460m), across Ethereum, Optimism and Polygon

-

25% Uniswap V3 total TVL

-

80 projects have their liquidity managed via Arrakis vaults

Arrakis PALM - Protocol Automated Liquidity Management - a novel liquidity bootstrapping mechanism that taps into the organic trading volume on UniV3. It is the first product built on top of the Arrakis infrastructure.

In essence, PALM is able to bootstrap liquidity by acquiring more base asset inventory. For instance, Abra can seed liquidity with an initial asset ratio of 95/5 in SPELL/ETH. PALM can progressively balance it towards a target ratio, e.g., 50/50, only by taking advantage of the volatility to make markets for SPELL. Not only will this approach save the Treasury from spending ETH on liquidity and SPELL on LP incentives, but it will also have no direct impact on SPELL price since the market-making is done via setting up LP positions instead of doingswaps.

Background & Motivation

Currently, the majority of SPELL liquidity on DEXs is on SushiSwap (SPELL/ETH, ~$2m), which is incentivized and takes on most of the DEX volume for SPELL. This has worked fine for the Abra community, and there isn’t any immediate need to change it.

There is also some SPELL liquidity on UniV3 (SPELL/ETH, ~$120k), which accounts for only around 6% of the liquidity on Sushi but has roughly 33% of the volume on Sushi. It is likely because of the high capital efficiency made possible by the concentrated liquidity feature of UniV3.

With that in mind, in conjunction with some preliminary discussions between the Arrakis and Abra teams, we believe that Abra can leverage the situation by deploying a sum of SPELL with PALM on UniV3 and gradually diversifying into ETH over time. By doing so,

- SPELL will have a stronger liquidity support managed by PALM. Once the liquidity managed by PALM proves to be able to handle the majority of the SPELL DEX volume, Abra community will have the option to wind down and eventually stop the incentives for LPs on Sushi.

- All of these neither require any additional incentives, nor create price impacts to SPELL price.

Therefore, we, as Arrakis, propose to provide Abracadabra with the full spectrum of market-making services on UniV3 with PALM, to reach the objectives mentioned above.

Specification

Phase 1 - Accumulate ETH

Abra Treasury allocates ~$200k worth of liquidity into a vault managed by PALM, in a ratio of 99/1 in SPELL/ETH. PALM uses this allocation to bootstrap ETH over time, with an initial target ratio of 50/50.

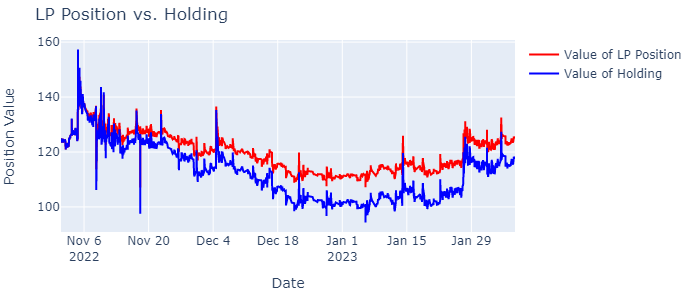

In order to construct the ideal PALM configuration for the objective, we have run simulations over the price history of SPELL between November 2022 and January 2023.

Based on the simulation outcome, the current PALM configuration is able to accumulate ETH from 1% to nearly 40% of the total liquidity in the vault.

Meanwhile, PALM manages to outperform simply holding the initial liquidity over the same time period, i.e., beating impermanent loss.

Phase 2 - Redefine the objectives

Once the initial target ratio of 50/50 is reached, the focus will be on market-making to create deep liquidity for SPELL, and to minimize and equalize the slippage on both the buy and sell side of the volume.

During the time of deployment, the Abra community has full transparency of the execution and performance of PALM via a custom dashboard, as well as retains full custody of the liquidity in the vault, meaning that at any point in time, the Abra community can withdraw the fund from the vault or revoke the managing access from PALM. PALM can only conduct market-making with the liquidity deposited in the vault, and will never be able to remove the fund.

For the services provided, Arrakis charges fees on two fronts:

- Management fee: 1% AUM fee on a yearly basis

- Performance fee: 50% of trading fees generated

Reference

For more information regarding Arrakis and Arrakis PALM, feel free to have a look at our docs and join our community. I’m also more than happy to respond to any comments here from the Abra community towards this proposal!

Website: https://www.arrakis.finance/

Docs: https://resources.arrakis.fi/

Twitter: https://twitter.com/ArrakisFinance

Discord: Arrakis Finance

Telegram: Telegram: Contact @arrakisfinance

Voting

Snapshot voting starts monday 13th of March, and can be found here.

The proposal has passed!